New commercial vehicles tax worry dealers

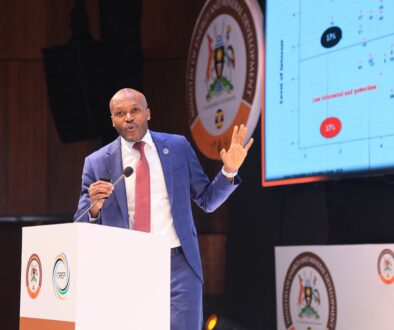

CAPTION: Malik Asim, Director Al-Zaryab Motors Ltd shows journalists July 11th 2025.

By Stephen Wandera Ouma

KAMPALA – Dealers in locomotives have hailed Uganda Revenue Authority on its remarkable revenue collection performance for the Financial Year 2024/25, surpassing its set target and registering a surplus of Shs262.43 billion.

According to members of the Delight Car Association in Uganda, the success has been achieved partly due to their members’ diligent compliance by paying taxes on time.

They however warned that this achievement could rekindle due to the new tax recently imposed on commercial vehicles.

William Eripu, Spokesperson, Delight Cars Association in Uganda says the new tax will increase retail prices for transport companies which affects the factors of production and in the end lead to higher prices for goods and services.

“Transportation of goods and service is a key driver of the economy. The tax is to increase the cost of production will eventually push off retail prices for goods and services,” he said.

Eperu further explains, “transporters may resort using old truck for transport as a cheaper option which may end up causing accidents because of being in dangerous mechanical condition.”

Muhammed Shahzad, Senior Vice Chairman of Delight Cars Association in Uganda warned if no remedy is found many of their members may be pushed out of business.

CAPTION: Muhammed Shahzad, Senior Vice Chairman of Delight Cars Association in Uganda in his office July 10th 2025.

“The new tax is pushing up the prices of commercial vehicles and the more they become, the fewer the buyers. This is not a good signal to the transport sector. As an association, we call upon the government to consider its stand.”

In a related development Delight Cars Association in Uganda has petitioned Ministry of Works and Transport for delay in processing digital number plates.

Referred to as the Intelligent Transport Management Systems (ITMS), the plate system aims at enhancing security and vehicle tracking. The digital plates are embedded with chips, part of a broader initiative to modernise the country’s vehicle registration and road safety.

On July 1, 2023, vehicle registration and number plate functions were transferred from the Uganda Revenue Authority (URA) to the Ministry of Works and Transport (MoWT), which is managed by Joint Stock Company Global Security.

According to members of the Delight Cars Association in Uganda, ever since the new management took charge, the process has affected their business.

CAPTION: Malik Azhar, Chairman (R) Delight Cars Association in Uganda with other car dealers July 10th 2025.

Muhamad Usama, Director Fuji Motors said the delay is too much and if the situation does not normalise business may collapse.

Malik Azhar, Chairman, Delight Cars Association in Uganda, said the delay means increased cost of doing business.

He also congratulated Commissioner General of URA and Commissioner of Customs URA with the whole of their team for reaching and exceeding the target goal set for tax earnings.

He also stated how last year April, him and his team had a meeting with URA and discussed on the situation of valuation for vehicles, in which they concluded that URA would engage with them after every 4 months to discuss vehicle valuations guidelines, but instead that was their last meeting, further no meetings took place.

Malik suggested for meeting with URAs team and work together to set goals on which both sides can leave satisfied, while also helping build Uganda’s economy together.

Malik Asim, Director Al-Zaryab Motors Ltd, urged Joint Stock Company Global Security to speed up the process since increased turnover benefits all of them.

In a phone interview the Bageya Waiswa, Permanent Secretary Ministry of Works and Transport acknowledged to the delay attributing it to hiccups in procurement of materials used in production. He assured members of the Delight Cars Association in Uganda the situation will normalize soon.