DTB Uganda eyes UAE, Asia remittance markets

CAPTION: Diamond Trust Bank (DTB) management receive the prestigious ISO 27001:2022 certification, affirming its commitment to global standards in information security management and cementing its position as a leader in Uganda’s evolving digital banking landscape. (Courtsey photo).

KAMPALA – Diamond Trust Bank (DTB) Uganda has announced a strategic shift towards the rapidly expanding remittance corridors between Uganda and the United Arab Emirates (UAE) and Asia, as inflows from traditional sources such as Europe and North America begin to plateau.

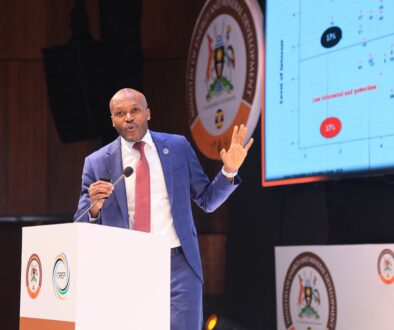

For years, Uganda’s remittance landscape was dominated by diaspora communities in Europe and the U.S. However, DTB CEO Godfrey Sebaana says that trend is shifting, with the UAE–Uganda and Asia–Uganda routes now leading in transaction volumes. The change is driven by a growing number of Ugandans seeking employment in the Gulf and parts of Asia.

He said in response, DTB is stepping up its efforts to provide secure, transparent, and user- friendly remittance solutions. Through a mix of bank account integrations and mobile money platforms, the bank ensures funds are reliably delivered and remain under the sender’s control.

Sebaana said DTB has also strengthened partnerships with global remittance leaders such as Western Union, MoneyGram, and TerraPay, while investing heavily in digital technology to streamline the remittance experience.

With Uganda receiving over $1 billion annually in remittances, Sebaana stressed that financial institutions have a responsibility to turn this inflow into sustainable impact. He said DTB processes nearly 800,000 remittance transactions each year, giving it a clear view of diaspora behavior and evolving needs.

“Remittances are no longer just for consumption. Diaspora communities want safe, high-value investment opportunities back home, and we are responding with tailored solutions,” he said.

Among these innovations is simplified access to government securities, including Treasury bills and bonds, previously seen as complex or inaccessible. He said these offer diaspora investors stable returns in Uganda’s relatively stable currency and low-inflation environment.

Sebaana said DTB is also using remittance data to develop alternative credit scoring models, enabling diaspora clients to qualify for business and mortgage loans without traditional collateral.

Still, he acknowledged ongoing challenges. “Many in the diaspora want to invest but lack trustworthy guidance, or have been burned by unregulated real estate deals and fraudulent schemes,” he said.

To address this, the bank is investing in financial literacy and diaspora engagement, including virtual financial clinics and webinars focused on high-volume corridors like the UAE and Asia.

Moses Muguwa, commissioner at the Ministry of Finance, Planning and Economic Development, echoed the need for coordinated action. He said the government is working to strengthen Uganda’s remittance ecosystem through commercial diplomacy, global partnerships, and forward-looking regulation.

“We are engaging destination countries and global institutions like the OECD, UN, and World Bank to ensure a seamless, secure cross-border remittance environment,” Muguwa said.

He highlighted stablecoins and blockchain-based assets as promising tools that, if well- regulated, could reduce remittance costs from 10–20% to as little as one cent per dollar.

Muguwa also proposed the use of regulatory sandboxes to safely pilot financial innovations and floated the idea of a Diaspora Investment Trust to offer migrant workers transparent investment channels.

On the operational front, Masoud Obeid, chairperson of the Uganda Forex and Remittance Association (UFRA), urged support for money transfer operators and forex bureaus, calling them “critical intermediaries” in connecting families to diaspora earnings.

“Forex bureaus are on the frontlines, but we’re under immense pressure,” he said. He cited liquidity challenges, fraud risks, and rising compliance costs, including anti-money laundering audits costing up to Shs50 million, an amount many small operators can’t afford.

Obeid also pointed to technology gaps and limited access to national ID systems, which complicate Know Your Customer (KYC) processes, especially for migrant workers with inconsistent documentation.

He called on the government to grant forex bureaus access to the NIRA database to enhance identity verification and combat fraud. He also urged for a joint public education campaign to improve financial literacy among remittance recipients.

Meanwhile,

Diamond Trust Bank (DTB) has attained the prestigious ISO 27001:2022 certification, affirming its commitment to global standards in information security management and cementing its position as a leader in Uganda’s evolving digital banking landscape.

The certification, officially announced on July 30, recognizes DTB’s implementation of a robust Information Security Management System (ISMS), designed to safeguard customer data, enhance resilience, and minimise risks across the bank’s digital infrastructure.

DTB Managing Director Godfrey Sebaana hailed the achievement as a critical milestone under the bank’s broader PRIDE Strategy, which emphasises proactive risk mitigation and operational excellence.

“This certification represents a key victory in our strategy to stay ahead of emerging cyber threats. It reflects our resolve to adopt global best practices and protect the integrity of our customer data,” Sebaana said.

He further noted that DTB now joins an elite group of financial institutions that have adopted a structured, forward-looking approach to risk management, especially in the face of rising cyber threats across East Africa.

While handing over the certificate, Mike Kamau, Managing Director of Certi-Trust—the body that issued the certification—commended DTB’s diligence and foresight in embracing cybersecurity excellence.

“We are proud to award this certification to DTB. Their achievement sets a high benchmark for Uganda’s financial sector and reinforces the importance of prioritizing digital trust,” Kamau said.

The certification comes at a crucial time when Uganda’s financial ecosystem is rapidly digitizing. The surge in mobile banking, digital wallets, and online transactions has brought convenience—but also heightened exposure to cyber threats.

According to the National Information Technology Authority (NITA-U), financial institutions have faced a steady increase in sophisticated cyberattacks, including phishing, DDoS attacks, and data exfiltration. In response, regulators like the Bank of Uganda (BoU) have issued cybersecurity guidelines requiring banks to implement risk-based controls and report major incidents.

Sebaana emphasised that DTB’s certification is aligned with these regulatory expectations and reflects the bank’s dedication to client data protection.

“We recognise the urgency of cultivating a culture of security, innovation, and preparedness. This certification is not the end—it’s a foundation for continuous improvement,” he said.

He also praised the Uganda Bankers Association (UBA) for spearheading industry-wide initiatives like cyber intelligence sharing, vulnerability assessments, and simulation drills, which help foster a more secure financial ecosystem.

As Uganda positions itself as a regional fintech hub, DTB’s achievement sends a clear message: cybersecurity is no longer optional—it is a strategic imperative.