Housing Finance Bank launch boda riders product

CAPTION: Housing Finance Bank ED Ayebazibwe (left) and Fred Senoga, the Business Product Advisor of the “Union”, show off the MOU on housing. They were joined by HFB’s Head of the Microfinance Department, Annet Nakidde Sebugwaawo, Baker Kasawuli, General Manager of the United Boda Boda Riders Cooperative, Frank Mawejje, Chairman; and officials from the bus and taxi “Unions”.

KAMPALA – Housing Finance Bank (HFB) has signed a Memorandum of Understanding with “Union” —the national boda riders cooperative—in an initial step to strengthening and empowering riders, bus and taxi drivers, and in the future, women market vendors, with tailored financial solutions for a better livelihood.

As a first step, officials of National Boda Boda, together with bus and taxi drivers’ cooperatives, today witnessed the signing of a partnership that will see Housing Finance Bank extend loans to “Union” members to build decent houses and own land in Union villages. This will be run under the Zimba Mpola Mpola scheme at the Housing Finance Bank that enables riders to borrow between sh200,000 and sh50 million for, among other things, buying land and constructing houses.

HFB Executive Director Peace Ayebazibwe highlighted that the boda boda industry supports over 1.2 million riders, yet many remain excluded from formal banking.

“Through this partnership, we are providing affordable loans, digital payments, and savings support to help riders own assets, grow income, and plan for their families. This is empowerment in action,” she said at the bank’s head office in Kololo.

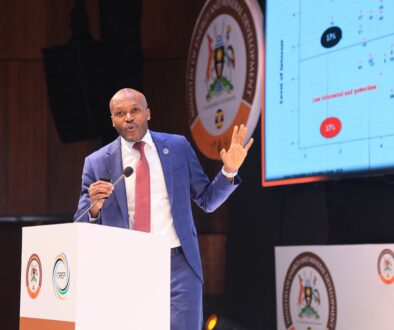

ED Ayebazibwe talks financial inclusion

ED Ayebazibwe noted that boda boda riders alone are a sector that is the 2nd highest employer in Uganda after agriculture, making it an area for the bank to advance their goal of financial inclusion for Ugandans.

“Up to 20% of Uganda’s population of 45.9 million depend on the boda boda industry. On average, a boda rider has a household of 5-9 members. If we support him or her in doing work, we reach up to 5 to 7 million Ugandans,” Ayebazibwe said.

She added, “Our partnership with Boda Boda riders goes beyond finance; it’s about creating jobs, supporting sustainable businesses, promoting affordable housing, and embracing eco-friendly solutions like electric motorcycles. At Housing Finance Bank, we are committed to building a future that benefits people, communities, and the environment.”

Earlier, the Head of the Microfinance Department, Annet Nakidde Sebugwaawo, reaffirmed the bank’s commitment to empowering the transport sector.

“We are proud to continue supporting riders and drivers with tailored financial solutions that foster decent living and economic growth. Together with the “Union”, we believe we can transform the transport ecosystem and uplift communities,” Nakidde Sebugwaawo said.

Senoga hailed

Housing Finance officials hailed Fred Senoga, the Business Product Advisor of the “Union”, for his efforts to unite the transport sector, by bringing together boda boda, bus and taxi drivers and having them use their numbers to improve their financial standings as a group.

“Through discipline, strong systems, and visionary leadership, we can unlock the full potential of Uganda’s transport sector. Through organizing boda bodas, taxis, and buses, we will transform it into a powerful economic engine, creating new opportunities for thousands to build their futures,” he said.

Numbers do not lie

“Numbers do not lie. In 90 days 10,000 EV bikes have been acquired,” he said, showing the benefits of partnerships for “Union” members.

Senoga revealed they intend to sell up to 100,000 EV bikes in the next year, 100,000 EV taxis and have a footprint in Uganda’s 72,000 villages by creating basic “Union” villages for housing in each of them.

Boda boda leaders across Uganda are encouraging riders to adopt electric motorcycles as a cost-saving and environmentally friendly alternative to petrol-powered bikes.

He said, the “Union” has embraced collaboration as its greatest strength.

“We have built partnerships across Uganda’s mobility, financial and ecosystem, including NSSF, to bridge the social security gap; Housing finance Ugnada for affordable housing projects; MTN Uganda for mobile money, device financing and connectivity; Next Media (NBS) for nationwide awareness; Spiro, Honda and Simba for bike supply; RZ Innovations for vehicle spare parts and supplies and Bleep for logistics and authentication technology,” Senoga said ahead of today’s MOU with HFB.

In the most recent partnership, the “Union” launched a partnership with the National Social Security Fund (NSSF), targeting to mobilise up to UGX365 billion annually from one million boda boda riders and taxi drivers.

“For years, riders have struggled to save consistently despite earning daily income. We are targeting to recruit 1 million boda boda riders, saving UGX 1000 daily,” Senoga said.