Crack down illegal money lenders, gov’t told

PARLIAMENT – The Ministry of Finance, Planning and Economic Development has one month to respond to the citizens’ outcry over the online money lenders said to be harassing people including top government officials.

The Deputy Speaker, Thomas Tayebwa, who is also a victim of harassment wants the government to crack a whip on the operations of online money lenders most of which are currently unregulated.

“We do not want to kill anyone’s business; we are saying let them be regulated. There is no one monitoring them; there is only harassment and harassment,” said Tayebwa while chairing the House on Thursday, 19 December 2024.

Tayebwa said he received threats from an online money lender asking him to pay for one of their debtors, who put his name and contacts as the next of kin while obtaining a loan.

The Deputy Speaker who took his plight to his X (formerly Twitter) handle, said he learnt that the online money lending group wields power and fights back at whoever attempts to challenge their illegal actions.

“There is someone called Legesa who has been fighting them but they are strong and fight back. People outside there are suffering at their hands, even government officials say they have been receiving threats,” Tayebwa said adding that his wife received similar threats from another company.

To his dismay, Tayebwa said, the individuals who contacted him on behalf of the money lending company did not allow him to explain his position and when he dared to, he was called a conman.

Tayebwa observed a general misuse of technology in Uganda, ranging from phone hacking, saying many have been cheated. He asked the Ministry of Information, Communication, Technology and National Guidance to Inquire into the misuse of technology.

Hon. Fredrick Angura (NRM, Tororo South County) said he received phone calls from an online company identified as Boda Banja threatening to arrest him if he did not clear a loan obtained by an unidentified debtor who registered him as the next of kin.

“People are running around, positioning themselves with our contacts. Many people are quietly dying at the hands of these loan scams. As for me when I asked for details of the matter, they told me they were coming to arrest me,” Angura said.

Hon. Christine Kaaya (NUP, Kiboga District Woman Representative) appealed to the government to investigate not only the online loan companies but also other online applications which are cheating people and failing to provide the services paid for.

“There is an App called Afromobile which was hosting a number of TVs and radios, [which] receives subscriptions but no longer offers any service. I pray that the government should dive into all applications; Mangu Cash, Banja Boda and others should have a limitation,” Kaaya said.

State Minister of Finance, Planning and Economic Development (General Duties), Hon. Henry Musasizi said he had already contacted Bank of Uganda on the reported harassment by online money lenders.

“I brought the matter to the attention of the officer responsible at the Central Bank and he acknowledged that this is the matter which has already been brought to their attention. He advised that we give them time to do a proper investigation,” Musasizi said.

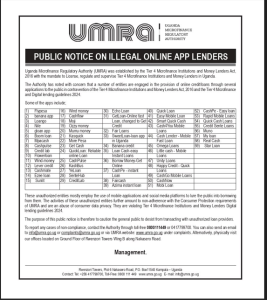

Meanwhile, the government through the Uganda Microfinance Regulatory Authority (UMRA) has listed illegal online money lending apps. UMRA is an autonomous Government Agency Expected to promote a sound and sustainable non-banking financial institutions sector. In a notice issued recently, UMRA said that “the Authority has noted with concern that several entities engaged in the provision of online credit/loans through several applications to the public in contravention of the Tier 4 Microfinance Institutions and Money Lenders Act, 2016 and the Tier 4 Microfinance and Digital lending guidelines 2024.”

LIST

The apps include Ezee loan, Quick loan, Star Loan, Quick Cash Loans, Echo Loan and Lever Credit among others.

According to UMRA, the entities listed above “mostly employ the use of mobile applications and social media platforms to lure the public into borrowing from them.”

“The activities of these unauthorized entities further amount to non-adherence with the Consumer Protection requirements of UMRA and are an abuse of consumer data privacy. They are violating Tier 4 Microfinance Institutions and Money Lenders Digital lending guidelines of 2024,” added UMRA.

UMRA appealed to the public to desist from transacting with unauthorized loan providers.